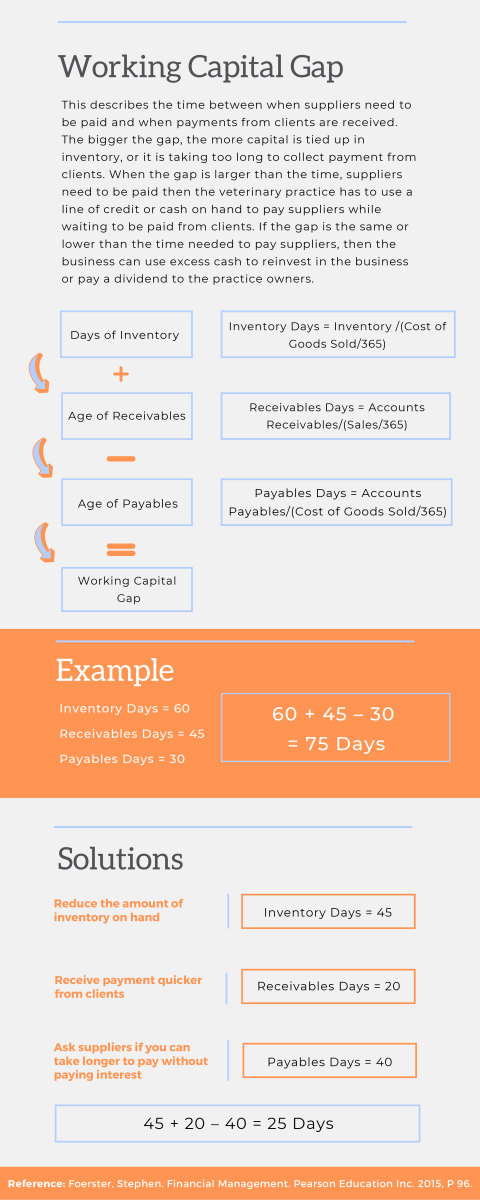

Veterinarians have to pay bills, and clients owe veterinarians money. This is the “working capital gap.” The working capital gap describes the time between when suppliers need to be paid and when payments from clients are received. Veterinarians need to “close” this gap in order to be more profitable.

The four key areas of the working capital gap are:

- Inventory—How many days does it take you to sell each piece of inventory?

- Bills—When are your bills due?

- Accounts receivable—How long does it take clients to pay you?

- Loans/Leases

The Business of Practice podcast is brought to you by Dechra Veterinary Products.

Ask your accountant or bookkeeper and get a Profit & Loss statement, said Pownall. Then determine average days of inventory. If it is over 30 days (vet practices often are closer to 40-50 days) that is a lot of inventory. “Depending on where we are we can usually get shipments in 24 hours. I want from 1-3 weeks of inventory on the shelves,” said Pownall.

See the infographic below on the Working Capital Gap from Dr. Pownall.

The Business of Practice podcast is brought to you by Dechra Veterinary Products.