Many of you are feeling anxious about the COVID-19 pandemic and the economic recession that we are careening into. Your concern and anxiety, which might be accompanied by some sleepless nights, can be improved by thinking hard about your financial situation and having a plan.

Just those steps can help you feel more calm.

In this article we’ll delve into your finances, determine where you might be headed based on where you have been and where you are now, and offer you a way to determine a solid financial foundation in order to rebuild your future.

Making a Plan

The plan you create will need to be flexible, because you will need to change it as conditions change, which they likely will. Your plan needs to be based on conserving cash. That needs to be your primary goal. In order to conserve cash, you will need to trim expenses, because you are likely to have diminishing revenue.

Your expenses are in five categories:

- Cost of Goods/Professional Services

- Employee Costs (which includes pay for all veterinarians),

- Administrative Costs

- Fee Collection Costs (mostly credit card fees)

- Facility and Equipment Costs

Of these, only the first two are variable and are costs that you can control.

Fee Collection costs vary with the payments you receive. The others are mostly fixed expenses.

For example, your state license, your liability insurance or your electric bill don’t vary much if at all based on how much work you do and how much revenue you earn. Your lease, if you have a facility, will stay the same, as will your computer software subscription and cell phone bills. Because of this, the expenses you can control are mostly in employee costs, and some that can be manipulated in the Cost of Goods/Professional Services category.

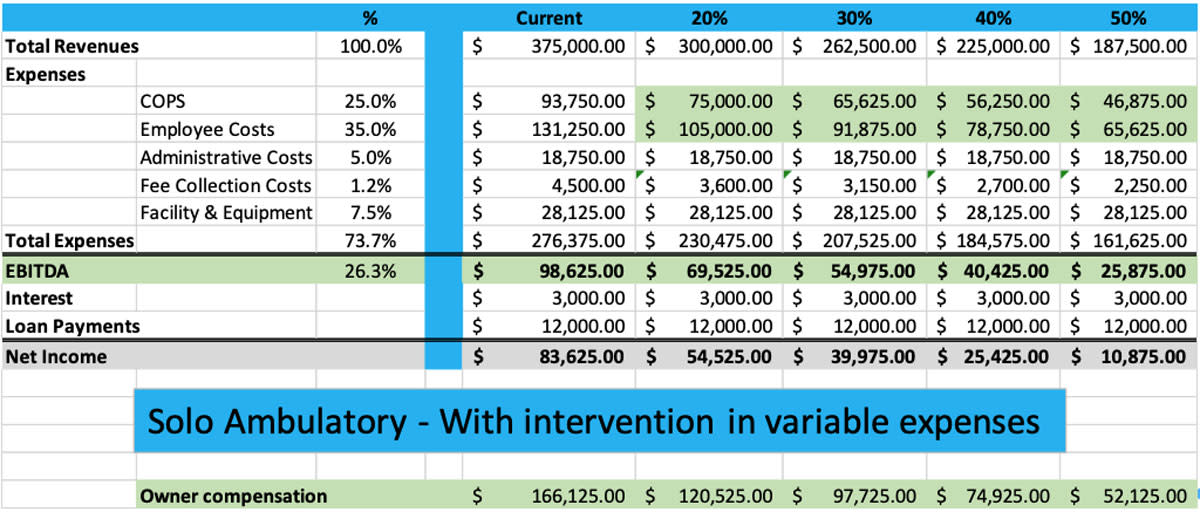

Here’s an example of a solo practice with average expenses showing what happens as revenue drops, both with expense adjustments and without.

In this scenario, the veterinarian makes sure to keep drug and supply purchases no more than 25% of revenue and employee costs at no more than 35% of revenue.

The practice has principal and interest payments totaling $15,000 per year.

The veterinarian was making 22% of the revenue plus 100% of the net income before the financial downturn. This is represented in the line called Owner Compensation. You can see what happens as the revenue goes away, even with the expense adjustments. If this veterinarian has a lot of personal expenses, he will have trouble meeting his obligations.

If the doctor is too worried to look carefully at the practice performance, or he doesn’t understand the relationship between revenue, expenses and profit, and decides that hope is a good strategy, here is what could happen.

As net income drops, this veterinarian doesn’t order the same amount of pharmaceuticals he normally does. Therefore, his drug and supply costs decrease. However, they are still purchased at a rate higher than 25% of his actual revenue (his practice normal). He also makes no adjustments in his staff costs at all, because they are depending on him for paychecks, and he feels responsible for their well-being. All the fixed costs remain the same, with the exception of fee collection, which varies with the revenue.

You can see that in this scenario, where the veterinarian is paid 22% of revenue and 100% of net income, that he gets into financial trouble much earlier. It is possible this practice won’t be able to continue for long.

The time to cut expenses is before you run out of money.

In your practice, compare this month’s gross revenue to last year’s gross revenue in the same month to know what % your revenue has fallen. You need to trim expenses to make up for that loss.

Remember that unemployment is available for your employees.

Many states learned in 2008 that having folks still working part-time and collecting unemployment part-time was better than their employer’s laying them off altogether. Thus, unemployment will often pay for hours lost when you cut work hours for employees. Check the website of your state’s unemployment division.

A Message From Our Sponsor Merck Animal Health

At Merck Animal Health, we are committed to doing all that we can to help you during these challenging times, while simultaneously prioritizing the safety of our own employees. The Merck Animal Health equine team is currently offering complimentary virtual CE opportunities to veterinarians and veterinary technicians, as well as one-hour educational seminars via WebEx for your clients. Contact your equine sales representative to learn more and arrange a time. Finally, we are committed to equipping you with additional resources you may need to get through this difficult time, such as this article from Dr. Grice, and by partnering with EquiManagement to bring you the 2020 Disease Du Jour podcast series. Our thoughts are with all those who have been impacted by this outbreak. Thank you for everything you do for the horse. Please contact your Merck Animal Health sales representative with questions or call customer service at 1-800-521-5767.

Same Scenarios, Bigger Practice

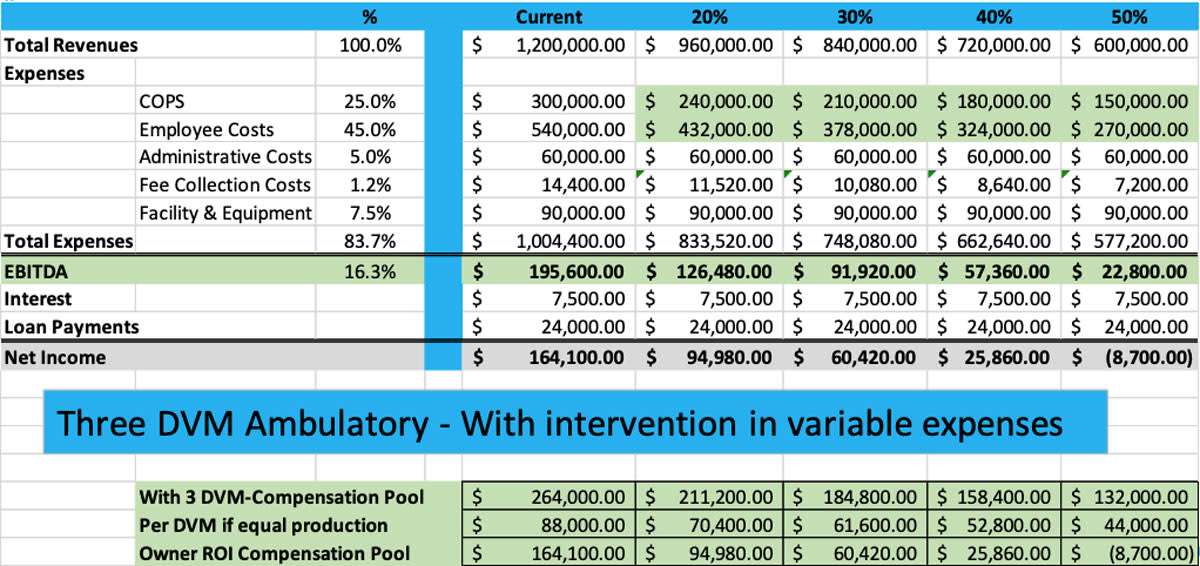

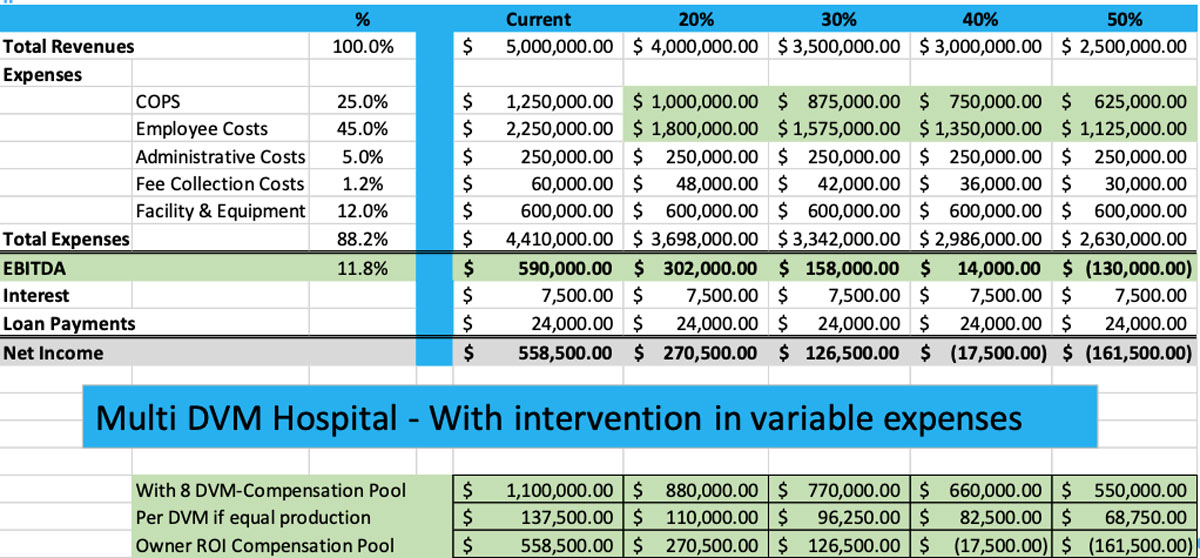

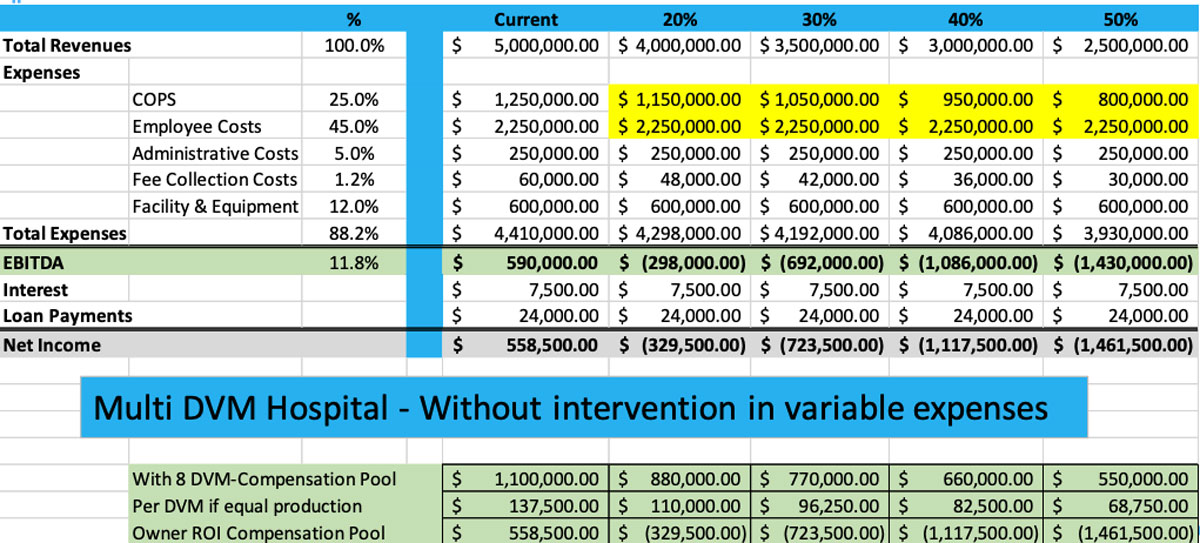

Here are also the scenarios for bigger practices, a three-vet ambulatory practice and an eight-doctor hospital practice.

With the higher costs of a facility, you can see that the big practice can get into trouble pretty quickly. Note that the veterinarian compensation pool is split here equally since individual revenue production is unknown, and the owner compensation pool will be split according to percent of ownership among the partners, which is also unknown.

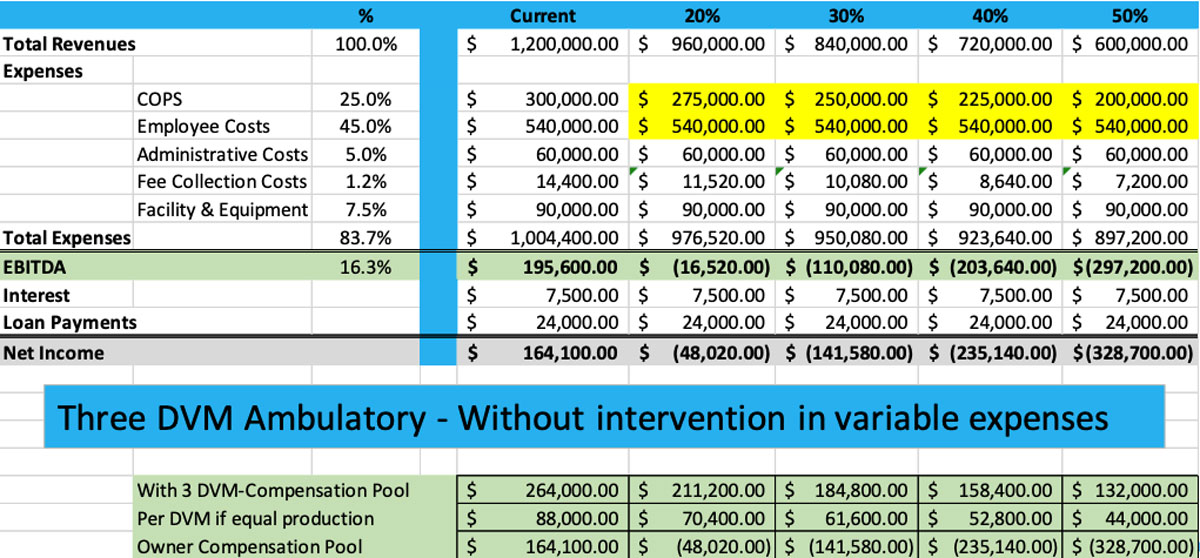

Here is what happens without cost cutting:

The owners of this practice have to start dipping into their compensation as veterinarians to meet the obligations of the practice—with just a 20% decrease in revenue! As the revenue drops further, the pain increases and could be untenable. Realizing the actions that must be taken and taking them early in the crisis is essential.

For the big practice, here is the scenario:

As long as cost cutting occurs promptly, this practice can stay profitable until revenue falls 40%. Certainly, if the owners are living high, or they are paying college tuition or a big mortgage, they will personally feel a huge pinch, but their business won’t fail.

Look what happens without intervention:

This practice will rapidly circle the drain, and the owners might be in significant trouble personally with their finances unless they can secure financing. Bankruptcies could occur.

Therefore, no matter the size of your practice, your crisis financial plan must include trimming expenses to match loss of revenue. You also can choose to (or might need to) supplement your earned revenue with funds from a Line of Credit (LOC) or other loan.

The Small Business Administration is offering loans at 3.75% up to $2 million with a 30-year term. You can learn more at www.sba.gov/disaster.

You might wish to engage your accountant to navigate this for you, as the application might have figures you are unsure of.

If you have a relationship with your local banker, reach out to see what resources they can offer you if you need an infusion of cash. Our federal government is likely to support banks in offering good terms and interest rates.

How to Reduce Expenses

Cutting staff is one of the things I know you don’t want to do, even during a financial crisis. You worked hard to find them, they are part of your practice family, they work well as a team.

Then look at your weekly payroll.

There are benefits that workers can get through unemployment from the state where you have been paying unemployment taxes for years. In order for there to be a business to come back to, if your revenue is dropping, you might need to reduce hours or lay them off now, before you can’t meet payroll and your business is in crisis.

With associates, most employment agreements can be renegotiated to move them to part-time and pay them a pro-rated amount based on their base salary. They are unlikely to leave you, especially if you continue to fully pay for their benefits during the downturn.

You could reduce the number of hours your office is open for phone calls and have your office staff work remotely answering a forwarded phone. If some staff have kids at home due to closed schools, they might be unable to work this way. The Families First Act will require you to pay them for 12 weeks, as of April 2, and take a credit for the total from your payroll tax obligation. If you pay for your employees’ health insurance, you will be able to take a credit for that, too. Guidance on this law is still emerging.

Inventory

Your industry partner reps are important to your business right now. Keep a good stock of items your industry partner reps tell you could be unavailable in the future months, but otherwise keep your inventory lean and be prepared to stock back up once your revenues increase.

If you bought a season’s worth of vaccines at the AAEP convention, explore extending your payment for them since the spring rush is likely to be delayed. If you have a large inventory of hyaluronic acid, you might want to return it, as fewer joint injections are likely to be needed due to cancelled competitions. However, keep in mind that some veterinarians are finding this extended “down” time from competition offers horse owners the opportunity to treat horses before the fall campaigns begin.

If you have leases or loans on diagnostic equipment, don’t wait until you are out of cash to renegotiate your obligations. Make the calls now. Perhaps you can pay interest only for six months. It is possible you might be able to negotiate a lower interest rate.

The same applies to your credit cards, if you carry balances. Call and ask for a lower interest rate. You might not receive one, but it does no harm to ask. You might be forced to pay minimum payments on credit cards for a few months. Again, preserve your cash. You might desperately need it.

Schedule farm calls as efficiently as possible in order to save on travel costs. Postpone elective purchases such as weekly car washes, but do not neglect vehicle maintenance such as oil changes and new tires when needed.

If you have been contemplating a big-ticket purchase, now is the time to wait. No one has a crystal ball to know how bad this downturn will be or how long it will last. If you must make a purchase, try to find something previously owned that might be less expensive right now. Then once the economy and your practice are back on solid footing, you can revisit the equipment you want to add to your practice.

Communication

Your staff and clients are anxious and worried, too. In the absence of facts, paranoid thoughts fill the void. If your staff is working remotely, communicate with a Zoom meeting or conference call weekly on the same day at the same time. If you are working in situ, meet weekly (keeping appropriate distancing from one another). Be reassuring. Say “This is what I know today. It may change by next week, but here’s the plan for the upcoming week.” Don’t lie and tell them everything will be okay. Share what you have learned about unemployment benefits and eligibility, new developments from your state government, and any other pertinent information.

It is important to be flexible and ready to pivot to a new reality. This won’t last forever, but while it does, you must be ready to make hard choices.

Communication with your clients is critical too. Send them a message that contains the following pieces:

- Assure them that you are there for them and their horses (and other animals if in a mixed practice), but with some different procedures (if you have adopted some). Explain why. If you aren’t doing elective surgery, explain the need to preserve personal protective equipment (PPE) for human caregivers on the front lines.

- Explain to them how you are caring for your staff because clients have interacted with them and often feel fondness for them. Knowing you are taking good care of your people will help them feel good about your practice.

- If you have different payment policies, explain them in a positive way. Consider saying “If you are concerned about finances because you have lost your job, please reach out to us so we can make a plan. We’re all in this together.” Because 70-90% of employed Americans will not lose their jobs, according to predictions, and horse owners are often from a wealthier demographic, and people are searching for ways to help others, you might consider creating an “Angel Fund” to help pay for care for horses (or other animals) owned by those that have become unemployed or ill with COVID-19. Continue to communicate regularly with your clients, even if your message is just a short update that you are still doing well and hope they are too.

- With non-clients, getting a credit card on file before traveling to attend an emergency is just good business. You really cannot afford to spend your cash if it is uncertain that you will be paid.

Take-Home Message

Take care of yourselves. Preserve cash by reducing your expenses. Communicate frequently, kindly and transparently with staff and clients with a mindset that we are all in this together. But remember in airline terms, you can’t help others with their oxygen masks until you put your own on. If your business fails, you will be unable to help all the people depending on you.

This article was brought to you by Merck Animal Health.