Credit: Arnd Bronkhorst

Credit: Arnd BronkhorstMost equine veterinarians remember their first inkling that they wanted to be vets, and often it occurred very early in their lives. So early, in fact, that it almost seemed like a “calling.” Even as you read this article, in classrooms all over the country, little girls are answering the question “What do you want to be when you grow up?” with the words “a veterinarian.” If they also love horses, invariably they want to be equine veterinarians.

This dream, and the passion that drives these students toward their goal, is not based on a rational assessment of the future economics of the veterinary profession. It is largely driven by the strong desire to leverage their intelligence and love of science in work they can embrace with enthusiasm.

Supply and Demand

Most veterinarians are familiar with the economic concept of supply and demand. Essentially these two forces remain in equilibrium through changing prices. When supply exceeds demand, prices generally fall; when demand exceeds supply, prices rise. In veterinary medicine, there is supply and demand for veterinary education, vet services and veterinarians. Students seek education to become veterinarians, and academic institutions supply it. Animal owners seek veterinary services that are supplied by veterinary practices. Lastly, veterinary practices seek veterinarians to supply the manpower to provide these services. Let’s consider these in turn.

Veterinary Education

In 2014, there were nearly 7,000 applicants to U.S. veterinary schools; these animal-loving students are focused on having careers they feel passionate about. In a survey of applicants, an astonishing 6.7% were willing to pay $750,000 or more for their education!1 This is an undeniable indicator that the demand for seats in veterinary colleges is very strong. Because of this demand for education (and in response to decreased state financial support), many veterinary schools have increased the number of available seats in their programs. Because obtaining admission to veterinary school in the U.S. is so difficult, many will attend foreign schools. In addition, there are three new veterinary programs in the U.S. beginning the accreditation process. In other words, in response to demand, supply is increasing.

The number of veterinarians graduating each year has risen 4% annually over the last five years, and it is projected to grow at least 2% per year into the future.2 Growth in the supply of veterinarians is projected to continue until 2018 before leveling off, according to Michael Dicks, PhD, head of the AVMA Economics Division. There were 2,812 graduates of the 28 U.S. veterinary schools in 2014. Now there are 41 U.S. accredited veterinary schools, so the actual number of students eligible to take the NAVLE and practice in the U.S. is more than 4,000 each year, according to Dicks.3

Because so many young people wanting to become veterinarians now attend schools outside of the U.S., over the last 15 years the percentage of graduates of U.S. veterinary schools taking the NAVLE has decreased from 90% to 65%.

Of the new veterinarians that graduate each year, historically about 5% will be equine focused. So of the roughly 4,000 new graduates, about 200 will be seeking to enter equine practice.

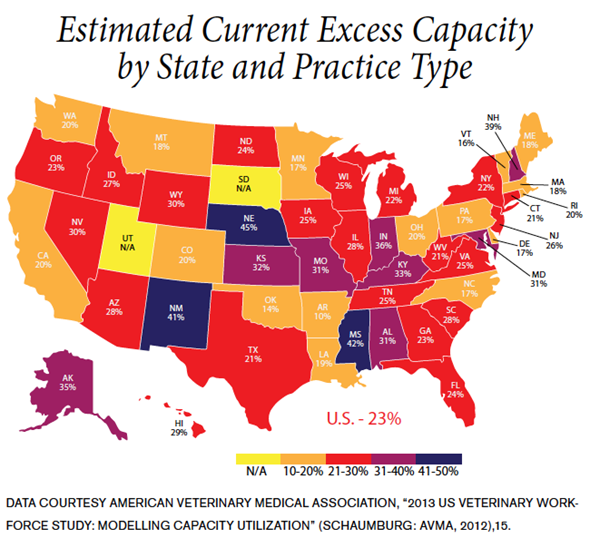

Recently the AVMA conducted a study to assess the current and future supply of veterinary services and veterinarians. The research, “2013 U.S. Veterinary Workforce Study: Modeling Capacity Utilization,” used sophisticated techniques to analyze the collected data and produce important conclusions. This study projected a 23% national overcapacity of equine veterinarians through the year 2025. The overcapacities by state ranged from a low of 10% in Arkansas to a high of 45% in Nebraska (see map below).

Veterinary Services

In the equine vet industry, demand for services has declined as the horse population has fallen from 9.2 million in 2003 to an estimated 6 million today.4 A 33% decline in patient numbers can only result in significant decline in overall demand. Lowered demand puts pressure on prices, because more services are likely to be sold when prices fall.

However, there are indications that the equine industry has stabilized somewhat, and equine practices are seeing upward trends in revenue from the troughs seen in the wake of the recession of 2008-2010.5 The AVMA Workforce study also predicted an increase in demand for equine veterinary services in the future, based on horses being increasingly seen as companion animals.

Veterinarians

After several years of sparse job opportunities for equine practitioners, recently more openings have become available as practices see resumed demand for services and older veterinarians retire. It is estimated that 50% of equine veterinarians are now 50 years of age or older. As these older doctors leave the workforce over the next decade, there should be increasing demand for young associates. However, according to a 2012 study by the National Research Council, the need for new equine veterinarians was projected to be only 122 per year nationally.6

The recent AVMA 2015 Report on Veterinary Markets reported that of the current 100,137 veterinarians, just 4.4% are in equine practice. When looking at new veterinarians, of the 16,267 that graduated in 2010-2014, only 1.9% are employed in equine practice, reflecting the industry’s downturn.7 But as the aged cohort steps aside, there will be opportunities for young equine practitioners. It is likely that demand for new equine vets will continue to grow very slowly in the short term, and it is not likely that all veterinarians seeking a career in equine practice will find jobs waiting in the near future. Supply exceeds demand in this area of practice. Not surprisingly, this keeps salaries (prices) lower.

Ordinarily supply and demand interact through pricing to come to equilibrium, where supply equals demand. In veterinary medicine, this is not happening. Young people who dream of being equine vets continue to follow those dreams, despite the challenges.

Debt and Salaries

High student debt and low starting salaries have been headline news in recent years, but what is the real story? How does the current situation compare to “the good old days”? This is a subject that affects veterinarians of all ages and stages, so we all need to pay attention.

In the 2013 New York Times article “High Debt and Falling Demand Trap New Vets,”8 writer David Segal stated that according to the AVMA, the median annual cost of attending vet school (including out-of-state tuition, fees and living expenses) was $63,000, an increase of 35% in the last decade. Starting salaries for all disciplines (adjusted for inflation) have decreased by about 13% during the same 10-year period, to $45,575 a year. Figures from the AVMA 2015 Veterinary Markets Report showed that tuition at 28 U.S. veterinary schools had increased by an average of 9.14% per year over the last 15 years.

Increased demand for veterinary school education continues despite rising tuition and salaries inadequate to support the debt incurred to earn the degree. Because of these human factors, a solution to the problem is not likely to spontaneously arise through the economic principles of supply and demand.

In equine practices, associate compensation is often in the form of a base salary with a production bonus after sufficient revenue is earned. Most base salaries range from $45,000-$60,000. Associates are limited in their ability to earn more revenue due to the weak demand for services. Having the will to work more hours and perform more services is of limited use in increasing earnings because you cannot satisfy demand that doesn’t exist.

Andy Clark, DVM, MBA, a wellknown business consultant in the equine veterinary field, wrote passionately in a blog about this dilemma: “We have inadequate demand for veterinary services to support the number of veterinarians in practice. Increasing class size diminishes the earning potential and therefore the value of a veterinary medical degree, yet the cost of the degree continues to escalate. That strategy only works for schools because student loans are easy to acquire and young consumers following their life’s dream are still willing to borrow the money to purchase the degree at an ever-higher price with challenging terms. The cost of the veterinary degree goes up while the value of a veterinary degree goes down and students continue to purchase degrees on borrowed money.”9

There were 2,608 students answering the 2014 AVMA Survey of graduates who indicated their levels of debt upon graduation: Graduating with no debt whatsoever was reported by a lucky 11.6% of the students, while only 19.7% reported they had less than $50,000 of debt. Overall, 50.3% reported having borrowed more than $140,000. Of concern are the 20% with more than $200,000 in loans, including a small cadre of 261 students with more than $250,000 of educational debt. It is generally accepted that a debt-to-salary ratio should not exceed 2, but it’s easy to see that many graduates are markedly exceeding that recommendation.

How does this compare to the situation in the past? In 2007, Chieffo, Kelly and Ferguson published a study in JAVMA that compared graduate debt and starting salaries in 1989 with those in 2007. In equine practice, the debt-tostarting salary ratio increased from 1.19 in 1989 to 2.7 in 2007. This means the average debt of graduating veterinarians in 1989 was about the same as their starting salaries. Contrast that to 2007, when the average new doctor’s debt load was almost triple his or her starting salary! Increases in starting salaries grew the slowest in equine practice during this 18-year period, increasing just 2.87% per year compared to an overall rate of 4.6% for all practice types. Despite this trend, numbers of new veterinarians entering equine practice grew during the five years preceding the study.10

Surveys of new graduates’ salaries can be difficult to interpret, especially when compared with past years’ data, because so many graduates now pursue internships in equine practice. Many, if not most, of the jobs available in equine practice now require completion of an internship, which was not the case in the past. Approximately 200 equine internships are offered in the U.S. each year, and only a small number of those veterinarians go on to do further specialty training. The rest become the newest cadre of equine associates. The debt-tostarting salary ratio is still unsustainable for many graduates even when looking at a generous associate’s base salary.

Managing Debt

It is important for graduates to make active management of educational debt a priority. The AVMA recommends visiting www.finaid.org, a web page with good advice for borrowers.11 Important steps for managing debt include:

- Ignoring it will not make it go away.

- Make payments on time. Many lenders offer discounts for borrowers who set up auto-debit. For example, federal loans offer a 0.25% interest rate reduction and private student loans offer a 0.25% or 0.50% interest rate reduction.

- Pay off highest-interest debts first.

- Make sure to deduct student loan interest on taxes when eligible for the deduction. Up to $2,500 in student loan interest (federal and private) may be deducted each year. Always check with an accountant for the most up-todate advice.

The AVMA’s website also has good resources to help graduating veterinarians manage their student debt.12 Educational debt repayment can be made more manageable by several methods. The first is through consolidation, where multiple loans are replaced with a single loan. The consolidation loan’s interest rate is generally the weighted average of the interest rates on the individual loans being consolidated. Consolidation provides access to alternate repayment plans, which reduce the monthly payment by stretching out the loan term but increase the total cost of the loan.

According to the AVMA website, there are four main repayment plans for federal education loans. Each of three alternatives has a lower monthly payment than Standard Repayment, but extends the term of the loan and increases the total amount of interest repaid over the lifetime of the loan. If more than $30,000 of debt has been accrued, the graduate is eligible for a 25-year extended repayment schedule without consolidation.

Standard and Extended Repayment plans assume that the loan will be repaid in equal monthly installments through standard loan amortization. The Standard and Extended plans include Federal education loans (Stafford, Perkins and PLUS) and most private student loans. Depending on the loan amount, the term may be shorter or longer, but remember: Extended repayment plans that allow a loan term of 12-30 years reduce each payment, but increase the total amount repaid over the life of the loan.13

Income Based Repayment offers two options, 15% and 10%. The 15% option was established by the College Cost Reduction and Access Act of 2007 and became available on July 1, 2009. The monthly loan payments are capped at 15% of discretionary income with forgiveness of any remaining debt (including accrued, but unpaid, interest) after 25 years. The 10% option was established by the Health Care and Education Reconciliation Act of 2010, which established an improved version of the income-based repayment plan for new borrowers of new loans made on or after July 1, 2014. The improved IBR plan cuts the monthly loan payments from 15% of discretionary income to 10% and accelerates loan forgiveness from 25 years to 20 years. For borrowers who don’t work in public service careers, the write-off of the remaining balance at the end of 25 years is taxable under current law.14

Income Contingent Repayment makes repaying education loans easier for students who intend to pursue jobs with lower salaries, such as public service. It does this by annually adjusting the monthly payments based on the borrower’s income, family size and total amount borrowed. ICR is available only from the U.S. Department of Education.

Income Sensitive Repayment is an alternative to ICR for loans serviced by lenders in the FFEL Program. It is designed to make it easier for borrowers with lower-paying jobs to make their monthly loan payments. The monthly payment is pegged to a fixed percentage of gross monthly income, between 4% and 25%. The percentage that must be paid is determined by the borrower, and the resulting monthly payment must be greater than or equal to the interest that accrues. The loan term is 10 years.

Graduated Repayment starts the payments at a low level (usually interest only) and gradually increases the pay- ments every two years until the balance is paid. The loan term is 12 to 30 years, depending on the total amount borrowed. The monthly payment can be no less than 50% and no more than 150% of the monthly payment under the standard repayment plan.

Opportunity Cost

Opportunity cost is the cost associated with using time/money for a particular purpose when compared to the outcome of using that time/money in a different pursuit. For example, compare having $10,000 in a Certificate of Deposit paying 0.1% interest to having it invested in a stock earning 8%. When looking at a career in equine practice, Dicks reported that the return on the educational investment was a -3.8% when compared to the average educational investment and career earnings of a person with a bachelor’s degree. He calculated that the net present value of the vet career in dollars was -$502,357, with the break-even point beyond 65 years of age. That is sobering news, indeed!15

The opportunity cost of a career as an equine veterinarian is clearly high, but there also is the truth: “Money isn’t everything!” Having a career that is personally rewarding and allows a person to love what they do each day has a value that cannot be monetized.

Equine veterinary medicine often requires long hours, significant emergency duty and limited time for a personal life. This can exact a personal price. Too many veterinarians have sacrificed their health and relationships on the altar of veterinary medicine. In 2008, the AAEP found that only 29% of equine practitioners under the age of 30 were “very satisfied” with their job.16

As the next generation inherits the equine vet industry, it is likely that new paradigms will emerge that leverage the unique skills and attributes of these new practitioners to create a better work-life balance. More family-friendly schedules, collaborative emergency alliances and new methods of delivering care can be expected to decrease the personal cost of a career in equine medicine.

Take-Home Message

Life as an equine veterinarian continues to be the dream of many veterinary students. Many have already spent much of their lives participating in the equine industry, and they look to their careers as vehicles to combine their aptitude for science with their love of horses. They face the difficulties with courage and a “get ’er done” attitude. Their innovative ideas, technological skill and openness to change in how care will be delivered in the future are positive indicators of the success they will have. Despite the challenges ahead and the costs of becoming an equine veterinarian, these remarkable practitioners are determined to make their mark, and they will become the next leaders in our profession.

[1] American Veterinary Medical Association, 2015 AVMA Report on Veterinary Markets

[2] American Veterinary Medical Association, “2013 US Veterinary Workforce Study: Modelling Capacity Utilization” (Schaumburg: AVMA, 2012), 25.

[3] American Veterinary Medical Association, 2015 AVMA Report on Veterinary Markets

[4] Brakke Consulting 2014 Equine Megastudy

[5] Andy Clark & Ed Boldt,”Merck-Henry Schein National Equine Veterinary Economic Study 2013” (presentation at American Association of Equine Practitioners, Nashville, TN, 12/8/2013)

[6] National Research Council, Workforce Needs in Veterinary Medicine (Washington: National Academies Press,2012), 54.

[7] American Veterinary Medical Association, 2015 AVMA Report on Veterinary Markets

[8] Segal, David, “High Debt and Falling Demand Trap New Vets”. New York Times. Feb 23, 2013. http://www.nytimes.com/2013/02/24/business/high-debt-and-falling-demand-trap-new-veterinarians.html?pagewanted=3&src=xps (Accessed 2/11/2015)

[9] http://www.dvmmba.com/student-debtour-best-thinking-got-us-here/

[10] Chieffo, Carla, Kelly, Alan M., Ferguson, James. “Trends in Gender, Employment, salary, and debt of graduates of US veterinary medical schools and colleges” JAVMA, Vol 233, No. 6, Sept 15, 2008: 910-917.

[11] http://www.finaid.org/loans/20100727repayingloans101.pdf Accessed 2/11/2015

[12] https://www.avma.org/About/SAVMA/StudentFinancialResources/Pages/Repaying-Your-Debt.aspx. Accessed 2/11/2015.

[13] https://www.avma.org/About/SAVMA/StudentFinancialResources/Pages/Repaying-Your-Debt.aspx. Accessed 2/11/2015.

[14] Ibid.

[15] American Veterinary Medical Association, 2015 AVMA Report on Veterinary Markets

[16] National Research Council, Workforce Needs in Veterinary Medicine (Washington: National Academies Press, 2012), 54.