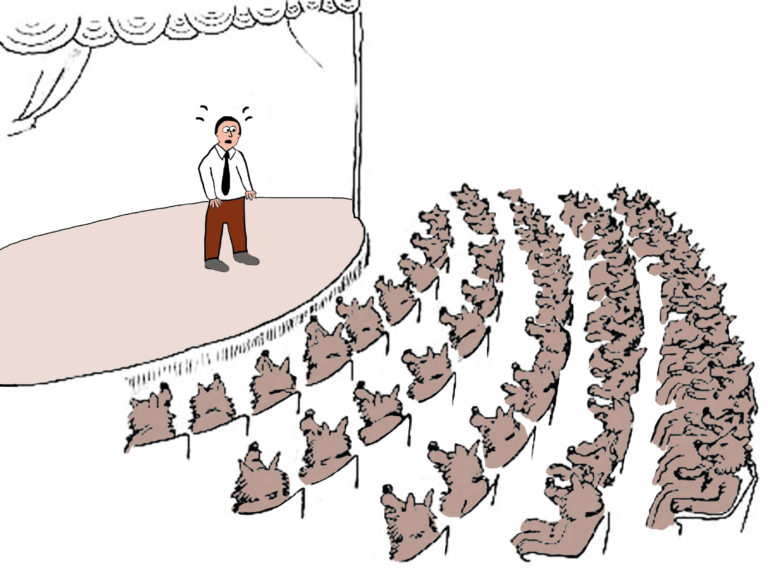

I know from first-hand experience the trials and tribulations of transitioning out of your veterinary business. First, you learn how hard it is to make that decision to list your business when it is has been the heart and soul of your professional life for so many years. When you finally make that decision to list your veterinary business, if you are not prepared, it can be a huge “OMG” moment. There was plenty I thought I knew and didn’t know, but should have known.

Case in point was a phone call from a DVM this morning who at 57 years of age thought if he listed his practice it might take a few years to sell. Wrong! Within a few weeks of the listing, he had several offers for the asking price. He was surprised at the speed at which there was a signed offer sheet. He thought he was prepared for a sale, but he really was not.

After signing the offer sheet, the seller asked his CPA what the tax consequences would be from the sale. The answer was Capital Gains plus some state tax for a total tax of about 25%. That sounded reasonable to the seller and he was content until late last week, when he found out the closing was the end of May and his tax bill would be nearly 40%–not the 25% he was told. The CPA had recalculated and discovered that more of the sale would be at Ordinary Income Tax Rates and less at the Capital Gains Rate.

Now what?

It was a stressful weekend for the doctor. All of sudden what he thought was going to be a long listing period was shortened, then the tax bill was significantly higher than he thought. It was not what he wanted, and if he could have an opportunity for a “redo,” he definitely would have done things a lot differently.

For one thing he would have done a better job at researching the tax consequences for his situation so he would have a better handle on what his net proceeds from a sale would be. As my mentor taught me years ago: “gross is for the ego, and net feeds the family.” In this case the net was not going to feed the family.

At this stage of the process, it was not in his best interest to back out of the sale, but to seek advice to find a more appropriate solution to his tax dilemma.

The seller was happy with the selling price that he is receiving for his business, but he was not happy about the tax implication. Can you blame him?

I gave him a possible solution for this situation, which was to work with a qualified tax attorney and/or tax advisor to discuss the creation of a Deferred Sales Trust.

What is a Deferred Sales Trust?

The Deferred Sales Trust is a legal contract between you and a third-party trust in which you sell real or personal property or a business to the Deferred Sales Trust in exchange for the Deferred Sales Trust’s contractual promise to pay you a certain amount over a predetermined future period of time in the form of an installment sale note (or promissory note).

It is often referred to as a “self-directed note” because you have control over the terms of the note.

The Deferred Sales Trust gives you the ability to control your capital gains tax exposure, reinvestment terms and installment payments made from the trust (http://www.jrwinvestments.com/articles/deferred-sales-trust/introduction-to-the-deferred-sales-trust/).

How Does It Work?

The process begins when a business owner transfers an asset to a trust managed by a third-party company. This makes it an arms-length transaction. The third-party company becomes the trustee over the asset, and you (as the business owner) become the beneficiary of the trust holding your business.

The trust sells your business and manages the distributions (this is an agreed upon installment contract set up in advance between the owner and the trust). The proceeds of the sale can be kept as cash, reinvested or distributed according to the seller’s installment contract. At the time of the sale there are zero taxes since trust purchases the property from the owner for the same price as it was sold for.

The tax code does not require payment of any taxes until an investor starts receiving installment payments, which will include some principle. You as the owner are able to control the installment frequency, amounts and how the monies are received.

Another way to look at this is that if you do not need the money now and can wait until you are in a lower tax bracket or the capital gains tax becomes more favorable, then you have that option.

Another option is to accept interest-only payments from the reinvested sales proceeds.

The answer to both options is that you have deferred taxes to fit your needs.

There are guidelines that you need to be aware of to make this work. First, it must be a bona-fide third party trust with a legitimate third party trustee. The trustee must truly be independent of the owner/beneficiary of the trust. Next for the Deferred Sales Trust to shield the owner from the taxes, the owner must not take constructive receipt of any sales proceeds. The trust must take legal title to sale proceeds directly from the sale or from a third party qualified intermediary that is holding the sales proceeds on behalf of the investor in order to qualify for tax deferral. Lastly, the asset ownership must be legitimately transferred to the trust prior to a sale for the sale proceeds to be sheltered from taxes.

Take-Home Message

This is an example of a possible strategy for a business owner. It might work for you, but before assuming it is the best option for your situation, make a decision to work with your estate tax attorney, CPA and Financial Planner to craft the best strategy for you.

You might have only one opportunity to sell your largest asset, so make sure you start planning well in advance of the time you list the business. Make sure your transition is well thought out as well as giving you a strategy to accomplish your goals. Be smart, be informed and be prepared for transitioning your business.