We encounter numbers in every aspect of daily life. As practitioners, we calculate the dosage of medications, generate invoices for services rendered and evaluate how we are doing each day by using numbers. Numbers are necessary to establish profit margins for the administration and dispensing of medications as well as in determining the value we place on our professional time for our service and expertise. These decisions have a powerful impact on the profitability and sustainability of our practices.

Let’s take a closer look at what we, as veterinary practitioners, know to be true. Each patient presents a diagnostic challenge, and by examining the facts and interpreting the clinical signs, we make judgments on a course of action to help the patient. This diagnostic approach is the same process we should use in making informed business decisions. Quality data that is consistent and reliable is analogous to improving your assessment of a disease process with the appropriate lab work or diagnostic equipment. The best decisions, whether for a patient or for the business, are made using the most appropriate and dependable tools available.

Our challenge is often our insufficient background and lack of business training. We graduate from veterinary school with the proper tools for practicing medicine, but lack the business training required to run a successful practice. On the most basic level, we have not been exposed to the language of business and finance. We must learn a whole new vocabulary, a new language, business nomenclature and numeric interpretations. Remember learning the new terms and definitions (medical language) in veterinary school, and trying to problem solve (SOAP) and relate all of the aspects into the decision-making process? Business management analysis and activities are no different; they require new terminology and new processes for a different aspect of your practice.

Diagnosis

To begin, you must develop an understanding of the language of business and the use of numbers as the foundation of diagnostic analysis and decision-making processes. In short, if you have a solid understanding of the numbers, you will be successful in your interpretation to improve your bottom line. In this article we will introduce the two fundamental accounting principles that are used in core business reports. The nomenclature is new and different, and by embracing a new approach to business terms and data analysis, we can use the information to improve our practice’s financial health.

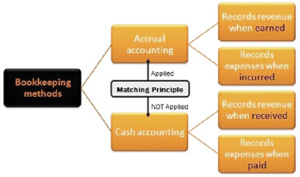

We account for our daily business activity and record information based on one or both of the following methodologies: cash-based accounting and accrual-based accounting principles. Money flows differently using these methods and your reports look only slightly different, but the use of the numbers in the report can be dramatically different. Both methods of bookkeeping have a great value for your practice; each has its own attributes. The primary difference in these reports is the timing of the activity of your business transactions and the rules each type of accounting follow.

The accuracy of the reports depends on a few fundamental questions. When is the revenue earned and reported? At what point is the earnings process complete? And when have the expenses really been incurred? The reports generated are called your financial statements. There are five standard reports, of which three are commonly used for management in equine practices today: the income statement, the balance sheet and the cash-flow statement. The basis of the numbers is the key to understanding how to use the individual reports.

In addition, we need to frame our business decisions on whether we are looking at the reports for tax planning purposes or whether the information will be used to make more time-sensitive operational changes for other strategic reasons. Often a practice may have two sets of books, one to manage its operations (accrual books) and the other for financial and tax planning (cash books). The guiding principles of the two approaches are described below:

Cash-Basis Data Entry & Reporting

Businesses that use this type of accounting record revenue only when cash is received and record the expenses only when cash or money is paid. This method of reporting is the most common method currently used in equine practices for tax planning. The limitation of this system is that it is hard to use these reports to help manage your business on a consistent basis. For example, if you wanted to compare the profitability of the same month in two different years when one year you paid a large insurance bill and in the other you did not, the comparison would be invalid. An annual expense in this case would be recognized at different times even though the expense may have been the same amount of money spread over a 12-month period.

Accrual-Basis Data Entry & Reporting

This type of accounting (bookkeeping) means that transactions that change the company’s financial statements are recorded in the periods in which the events occur (real time). For example, revenue is recognized at the time the services are provided, even if you do not receive payment from the client when you visit the farm or they come to your hospital. Expenses are reported when the expense occurs and not when you pay the bill for those supplies or items. This type of accounting provides a better matching of the activities of revenue and expenses and paints a more accurate picture of what is actually happening within your business. This is the preferred management accounting system used in most businesses today. The entry of expenses and revenue match the activity on a real-time basis.

Now that you understand how the numbers are attained and collected in your accounting system, the reports are a valuable tool to help your practice.

Take-Home Message

Understanding how numbers are entered, used, accounted for and reported is critical to the proper use of the information to arrive at your business “diagnosis.” Accrual accounting and bookkeeping are designed to provide timely management information that is valuable in the making of important, proactive management decisions in your practice. For more detailed information and additional free resources, including templates, white papers and business links on this topic, visit the resource page at: www.equinebusinessmanagmentstrategies.com.